What is Geological Risk Assessment?

GRA lets you assess the sensitivity and resilience of mine plans to changing economic conditions that affect prices and costs.

All mine plans are ultimately derived from a mathematical model that describes the geology of the deposit to be mined. Geological models should represent the best possible understanding of the real world, but it should also be recognised that they are subject to (often significant) statistical error.

Gaining improvements in the NPV of a mine plan by one or two percent is not meaningful if the confidence interval on the resource model is 95%.

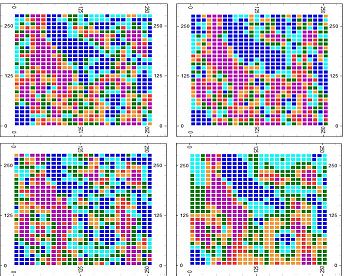

An example of GRA output

Your product has a set of integrated tools for using conditionally simulated models to assess the level of risk of a project that is derived from the inherent uncertainty of the geological model.

In order to explain how GRA allows this risk to be assessed, a few definitions are useful:

-

Conditional Simulation – Geostatistical methods of modelling mineral deposits that attempt to reproduce the range and spatial variability of grades in sample data. Instead of producing a single average case model, conditional simulation generates a number of equally likely models.

-

Simulated grades: – Grades in anyone of the models generated by conditional simulation.

-

Reference grades – Point grade estimates used for building standard economic models, pit optimization and scheduling. Usually, reference grades are the averages of simulated grades or are obtained by other geostatistical methods like kriging.

-

Geological risk – The potential effects of statistical errors in reference grades estimation on the life of mine plans based on the reference grades. The two main concerns are:

-

The life of mine plan may significantly overestimate the profits and NPV; therefore, the true return on investment may turn out lower than expected.

-

The mining strategies described by the plan may not be optimal.

-

-

Value models – Block models with a single field representing block net value for a particular conditional simulation model and given economic settings.

To assess the geological risks of a life of mine plan the conditionally simulated models need to be related to economic and technological parameters. The corresponding value models of the deposit are built and used to infer the probability distributions of vital planning statistics like profits and NPV. GRA allows this to be done and also offers a risk based method of selecting the ultimate pit limits. Confidence in the pit shape’s influence from the resource model can be sacrificed for more value.

Armed with the best information, an assessment can be made of potential value versus the probability of achieving that value.

OES and Geological Risk

In Studio NPVS all the stages of mine planning are represented by optimal extraction sequences. The sequences are optimal with respect to the reference grades however the value models can be used to evaluate profits and NPV for the simulated grades. Suppose there are 50 value models built from 50 equally likely conditionally simulated models. Using the mine plan based on the reference grades, GRA can calculate 50 equally likely profit and NPV values representing their respective probability distributions and the standard distribution parameters like median, mean, standard deviation, average deviation etc.

The probability distribution parameters, in particular standard or average deviations give a measure of risk. Large deviations relative to the mean indicate that the true profit (NPV) is likely to differ significantly from the predicted (mean) profit (NPV) and therefore signal that the project may be risky.

Risk Rated k-Pits

Suppose there are N value models built from N conditionally simulated models. For each value model an LG ultimate pit can be generated giving N pit shells each of which is equally likely to be the “true” profit maximizing optimal final pit shell. There may be blocks in the model that are included in all N shells; others may be included in N-1 shells, N-2 shells, and so on, finally some blocks will not be included in any shell at all.

Consider the pit shell (k-Pit) that consists of all blocks included in at least k LG ultimate pits, where k is an integer between 1 and N. It can be shown that any k-Pit adheres to the same slope rules as the LG ultimate pits so it can be used as the mine’s final pit shell. Like LG pits parameterized by product prices, k-Pits are nested, that is, the k-Pit is wholly contained in the (k-1)-Pit. The difference is that the k-Pits are ranked by geological risk whereas LG phases are ranked by economic risk stemming from price or costs uncertainties.

The risk rating of a k-Pit can be quantified as s = (100*k/n); the N-pit is rated as 100% safe, carries no risks, and the rating diminishes (the risk grows) for smaller values of k.

Like any other pit, a k-Pit can be evaluated for costs, revenues, NPV, tonnages and grades. Geological risk ratings in conjunction with these standard statistics may help you to choose final pit shell that strikes the right balance between risks and opportunities associated with any mining venture.

Related topics and activities